Who do you think was the biggest loss making financial institution in the world last year? Lehman Brothers? AIG? Citibank? No, it was not a major bank in a major world economy – it was a relatively small developers’ bank in Ireland – Anglo Irish Bank. What’s more, Anglo Irish Bank is likely to be the biggest loss maker again this year!

Who will foot the bill? Not the bankers, developers and politicians who allowed this incredible situation to develop, but ordinary taxpayers. In the first half of 2010, these losses amount to nearly €2,000 for every person in Ireland! Yet the government proposes an “orderly winddown” over the course of around ten years that will in total cost the taxpayer an estimated €25 billion to €40 billion – well in excess of all of the cutbacks being imposed by the government.

Brian Lenihan recently outlined his reasoning for this, declaring:

“…we must stand behind our banks in order to ensure that a sustainable financial system is established and, in the case of Anglo, to ensure that the resolution of its debts does not damage Ireland’s international credit-worthiness and end up costing us even more than we must now pay.”

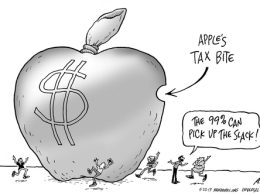

What it boils down to is this – Anglo Irish has made massive losses as a result of the loans it gave to developers and speculators who have now gone bankrupt. In a system supposedly built on “risk taking”, these losses should mean that Anglo Irish Bank would be unable to repay those it owes money to. However, as a result of the government’s capitalist nationalisation and guarantee, the taxpayer will pick up the bill as the government is promising to pay all of its creditors.

The vast majority of these creditors are not working people, but rich investors and speculators who chose to invest in the hope of making a profit. There is €16.5 billion of “subordinated” and “senior” debt, the vast majority of which is not held by ordinary householders. These investors should take their losses – with compensation only on the basis of proven need. In that way, the taxpayer would be saved the burden of paying for Anglo’s collapse.