By Ann-Katrin Orr

THE GOVERNMENT have come up with yet another outrageous claim; this time we are expected to believe that the rich pay their fair share of taxes!

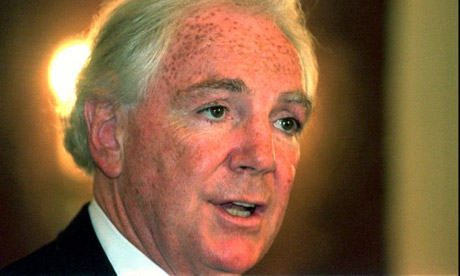

Brian Lenihan is trying to paint the image of a “highly progressive” Irish taxation system in which those who earn most pay most. To back up his claim he said that the top 1% of earners (who earn more than €200,000) pay 20% of all income tax. But this figure is misleading and Lenihan’s description of the taxation system is miles removed from reality.

He seems to have conveniently forgotten about the fact that the rich get billions in government subsidies and that a large number of them do not pay any taxes at all. One percent of Ireland’s population owns 34% of the wealth, and still this government feels the need to give the rich further handouts.

He seems to have conveniently forgotten about the fact that the rich get billions in government subsidies and that a large number of them do not pay any taxes at all. One percent of Ireland’s population owns 34% of the wealth, and still this government feels the need to give the rich further handouts.

According to ICTU over €1.5 billion a year could be saved by cutting subsidies to business, farmers and investors. Michael Dell for example profited from nearly €75 million given to Dell in the form of grants and premises.

Ireland’s corporation tax of 12.5% translates into another big handout to the rich and led to an estimated €40-€50 billion in profits being taken out of the country in 2008 alone.

Private companies and the rich are the ones who gain most from government subsidies to private pension contributions. An incredible 75% of total tax relief for private pension contributions, estimated at €2.5 – €3 billion a year, benefits the top 20% of earners. On top of this, the government is giving interest relief to wealthy landlords which over a two year period amounted to €1.4 billion – the same amount the government claims they have to now cut from annual public sector wages through the so called “pension levy”.

Lenihan’s claims are also completely exposed by the fact that ten of the richest 20 in the state pay no taxes at all. Out of 6,000 tax exiles 440 are “extremely wealthy” but not a single cent is collected from them in income tax. The rich instead hide in tax shelters which are costing billions every year but which this government has no intention of closing.

The government’s rhetoric is intended to make people think that the rich are already paying their fair share of the burden and to prepare the ground for further attacks on wages and living standards of workers. Any such farcical claims must be rejected by working class people.